Early Warning Signs: The Role Of Geographic And Marketing Challenges In The Akam Microinsurance Experience

Microinsurance is a work in progress. The successes of the microcredit models that achieved prominence in the 1990s proved that even very poor people were viable customers for financial services. Since those early days, a substantial body of scholarship has demonstrated that poor people need not just credit but in fact a full suite of financial services. Microinsurance is especially vital since it aims to mitigate the economic shocks (serious illness, death of a breadwinner, extreme weather event, poor harvest, or other such disruption) to which low-income families are chronically vulnerable.

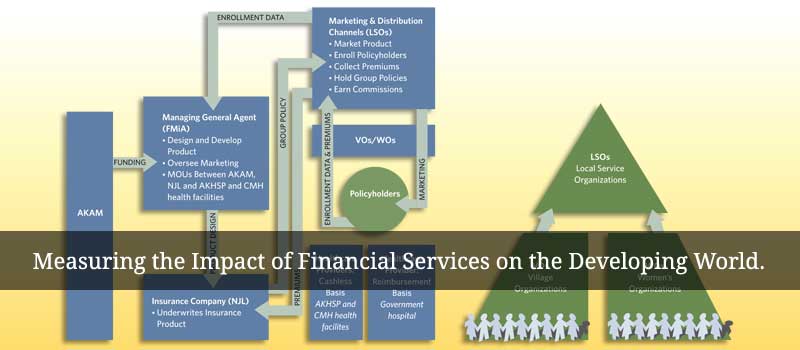

One of the most visible microinsurance start-ups was the Health Microinsurance (HMI) product launched in Pakistan in 2008. The HMI, a voluntary, private insurance, was designed and delivered by the Aga Khan Agency for Microfinance (AKAM) with support from the Bill & Melinda Gates Foundation. HMI's objective was simple: to prevent low-income families from falling into destitution as a result of catastrophic medical costs. In implementation, however, HMI's logistical complexities — along with its inherent riskiness — proved unworkable.

AKAM formally decided in March 2011 to discontinue the HMI. This decision followed months of mounting losses and the pull-out of key business partners. At the time of writing, the ultimate fate of the HMI is yet to be determined. New Jubilee Life (NJL), a commercial insurance company that is part of the Aga Khan Fund for Economic Development, had originally served as HMI underwriter and was considering taking over the program's administration in the wake of AKAM's decision to withdraw.

This Policy Brief draws on a Microfinance Opportunities (MFO) report of field research carried out during 2008 and on interviews conducted during 2011 with key AKAM staff. The Brief focuses on two key factors that contributed to the HMI's failure:

- the remote mountainous terrain that was home to the HMI target market

- AKAM's decision to use grassroots community organizations as the main marketing channel.

Both had been flagged as potential problems in the original report. AKAM's experience provides relevant lessons to the fledgling microinsurance industry as it looks for ways to serve isolated communities and assumes that insurance can be layered on to existing delivery channels. In the specific case of AKAM's HMI, numerous unforeseeable developments, including extreme weather events and political unrest, adversely affected operations. However, as the 2010 report documented, some of the early warning signs were clear from the outset.